Upcoming changes that may affect your commission checks

Posted: September 15, 2022 | By: Brian Posalski

As part of our constant efforts to maintain compliance with IRS rules & regulations, we are improving our policies and procedures pertaining to commission payments and income reporting.

We are putting out this communication in an effort to ensure we have a correct Tax ID associated with your Youngevity Distributor account. Without a correct your Social Security Number (SSN) or Tax ID (TIN), we are unable to report your earnings to the IRS, which means that as of October 1, 2022, we will have to withhold your earnings until we have received a valid TIN from you. For those of you who manage multiple accounts, including those for whom computers, smartphones or the internet are unavailable, we are asking you to work with your team to obtain this information.

Note that this is not a change in our Terms of participation in our compensation plan or our policies. Rather these are measures we are required to enforce more strictly going forward.

For any additional questions or concerns you may have about this update, please refer to some of the top questions we have received below, as well as their answers. For any additional questions, we’re always here for you at [email protected] or (800) 982-3197.

Commission Payout FAQs

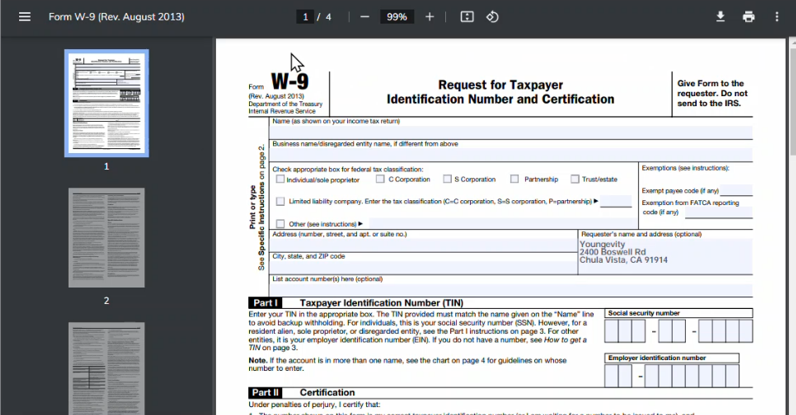

- What is the W-9 form and why do you need it?

IRS form W-9 is most commonly used by individuals and certain types of entities working as independent contractors. We use the information provided on this form to report your earnings to the IRS in compliance with IRS rules.

- What is the difference between a TIN, as SSN and an EIN?

A TIN is a tax identification number that can be either a social security number (SSN) usually issued an individual or an employer identification number (EIN) usually issued to a business.

Note: this is a good resource to better understand the need for a W-9 for this one: https://www.investopedia.com/articles/personal-finance/082714/purpose-w9-form.asp

- When should I submit my W-9?

If you are a US citizen or resident, we will notify you by email when your earnings reach $15.00, and we will ask you to fill out and send us a Form W-9. You will not receive a payment from Youngevity until we have a completed W-9 on file for your account, even if the earnings in your account are at the minimum payout level.

- How do I submit the W-9?

Complete a Form W-9 downloadable from here. Once complete, submit it back to us in one of three ways:

Option 1: Email to: [email protected]

Option 2: Fax 619-934-3205

Option 3: Mail to:

ATTN: CS Dept c/o Jonnie T.

2400 Boswell Road

Chula Vista, CA 91914

If you are unsure and want to double check, please reach out to our customer service team for verification. Our phone number is 800-982-3189 Monday thru Friday from 7am to 5pm PST.

- Why are we making changes?

Technically, we are not making changes; rather we are enforcing policies that have been applied for many years, and we’re creating a process by which we can do this easily. However, current IRS rules and regulations are becoming stricter over time, and we need to take steps to continue to maintain compliance with their rules.

- Will I be affected? How will I know?

If you have provided a complete Form W-9 to us in the past, you most likely will not be affected. We will contact you if necessary.

- What is the difference between a W9 versus the information I provided Youngevity upon my enrollment?

Upon your enrollment (i.e. your membership as a Distributor) with Youngevity, we collected enough information for us to process your order (i.e. billing information) and ship your order to the correct address (i.e. shipping information). We also collected information that would enable us to contact you in case there was a problem or question about your order or account, including email address and/or phone number. Lastly, we asked you to create a username and password to securely access your account. Lastly, we did ask for your Tax ID, but it was not required during your enrollment.

- Is my information safe?

Your TIN is saved in an encrypted database with secure & limited access by only those with a functional need to access this information for financial & accounting purposes and paper forms are in locked storage with limited access.

- What if I opted to leave TIN blank during enrollment?

We will no longer issue commission payments to those who have not provided their TIN, or to those the IRS has reported that the name and TIN do not match. Commissions will accumulate and be paid out once this information is provided.

- Can I still receive a commission check without providing my SSN or EIN?

No.

- What if I provide my TIN after my commission has already been held for one or more payment cycles

When you provide your W-9, we will pay any/all accumulated unpaid commission on the next regularly scheduled monthly commission cycle, assuming we’ve already processed your W-9. If you are providing an updated W-9 due to a verification problem, we will resume payments once we are able to successfully verify the information.

- How do I determine whether I’m someone who needs to remedy this situation?

If Youngevity’s customer service has reached out to you via email or by phone call, then that means Youngevity needs you to take action ASAP, otherwise, you are at risk of not receiving your unpaid commissions. Action steps needed: Please fill out the W9 form and submit it back to us in one of three ways:

Option 1: Email to: [email protected]

Option 2: Fax 619-934-3205

Option 3: Mail to:

ATTN: CS Dept c/o Jonnie T.

2400 Boswell Road

Chula Vista, CA 91914

If you are unsure and want to double check, please reach out to our customer service team for verification. Our phone number is 800-982-3189 Monday thru Friday from 7am to 5pm PST.

- Is there a way for me to actively check whether my account is missing a Tax ID?

Yes. If your account is associated with an address in the US, CA, AU or NZ, you may login to Youngevity.com, navigate to your Dashboard, can you can follow the prompts from there. Pls refer to screenshots below:

- Step 1: Login to Dashboard

- Step 2: Click Profile tab & scroll down

- Step 3: Click link(s) to W9 Form

- Step 1: Login to Dashboard

- Should action be needed from me, by when do you need my TIN?

If you have not received a communication from us regarding this, there is nothing you need to do today. But if you have received our a notification from us, we require this information ASAP. Again, your commissions will be withheld until we receive this information.

- When will this new policy/system go into effect?

October 1, 2022

- Why is Youngevity doing this now? Has this always been a problem?

These are measures we are required to enforce more strictly to be compliant with IRS rules.

- How long will Youngevity withhold my commissions if I do not share my TIN?

Indefinitely. After 12 months of unclaimed commissions, your commissions will be written off our books and given to the state as unclaimed property.

- Do I ever need to send you a new W-9?

Yes, if you update your name or change your account from personal to business or vice versa, then you will need to send us an updated W-9.

- What if I still have questions?

We cannot give personal tax or legal advice. If you still have questions returning the W-9 to us, contact Jonnie at Youngevity Customer Service by calling (800) 982-3197 or emailing [email protected].

- What is TIN Verification?

It’s a process where we verify the information provided on Form W-9 with the IRS.

- Why do we do TIN verification?

We have begun our TIN verification process to increase accuracy in our 1099 reporting

- What happens if the TIN verification process fails?

We will notify you what happened and request you complete a new Form W-9. In this case, it would be best to complete the W-9 with your name and TIN as it appears on your tax return.

- What if I do not file as an individual, and instead I’m signed up with Youngevity as a Corporation?

If you are Corporation (S or C), you will NOT be receiving a 1099 at the end of the year. If you are not sure whether you’re signed up with Youngevity as a Corporation or as an Individual, please contact us by calling (800) 982-3197 or emailing [email protected].

Posted in: